KOBIL for Financial Services

Empowering the Future of Finance with Secure Digital Transformation.

In a rapidly evolving digital landscape, financial institutions and Fintechs face an urgent need to modernize, innovate, and comply with stringent regulations. At the heart of this transformation lies one key element: trust.

The Financial Industry’s Foundation,

Trust and Security.

With KOBIL, you gain a platform that doesn’t just secure your operations - it redefines your business. From enabling strong customer authentication (SCA) to secure customer communication, digital signatures, and compliant payment flows, we help you build the future of finance.

Whether you’re a traditional bank or a cutting-edge Fintech, KOBIL empowers you with everything from KYC to transactions - all from one trusted partner.

Key Use Cases for the

Financial Industry

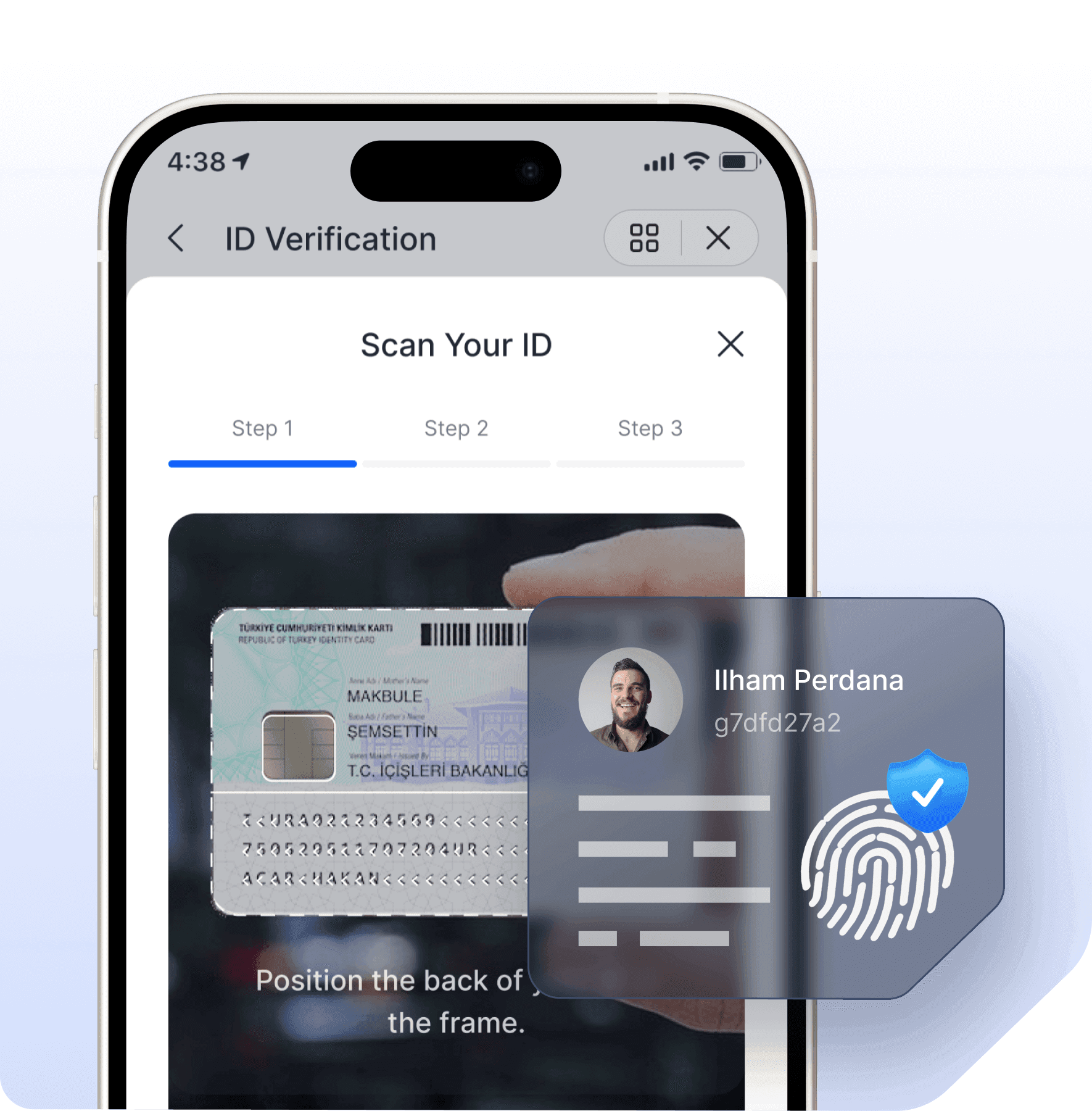

Seamless KYC and Onboarding

Welcome Customers with Trust.

Customer onboarding is the first impression - make it seamless, secure, and compliant

Instant Identity Verification

Use AI-driven processes for fast, accurate KYC.

Frictionless Onboarding

Eliminate unnecessary steps with device-bound digital identities.

Real-Time Document Verification

Ensure compliance with minimal user effort.

Regulatory Confidence

Built to comply with AML and eIDAS regulations.

Result: Faster customer onboarding, reduced drop-offs, and a superior first impression.

Strong Customer Authentication (SCA)

Compliant and Secure.

Meet the demands of regulations like PSD2 by integrating mIDentity into your app or platform.

Enable two-factor authentication with seamless user experiences.

Bind identities securely to devices for unbreakable trust.

Leverage AI-powered threat detection to protect against fraud in real-time.

Result: Compliance and security with frictionless customer interactions.

Transaction Security

Safeguard Every Payment.

Every financial transaction is an opportunity to build trust. With mSecure and mSign, we ensure that:

Transactions are verified using tamper-proof digital signatures.

Payment approvals are secured through device-bound identities.

Fraud is mitigated with real-time AI monitoring.

Result: Peace of mind for your customers and reduced operational risk.

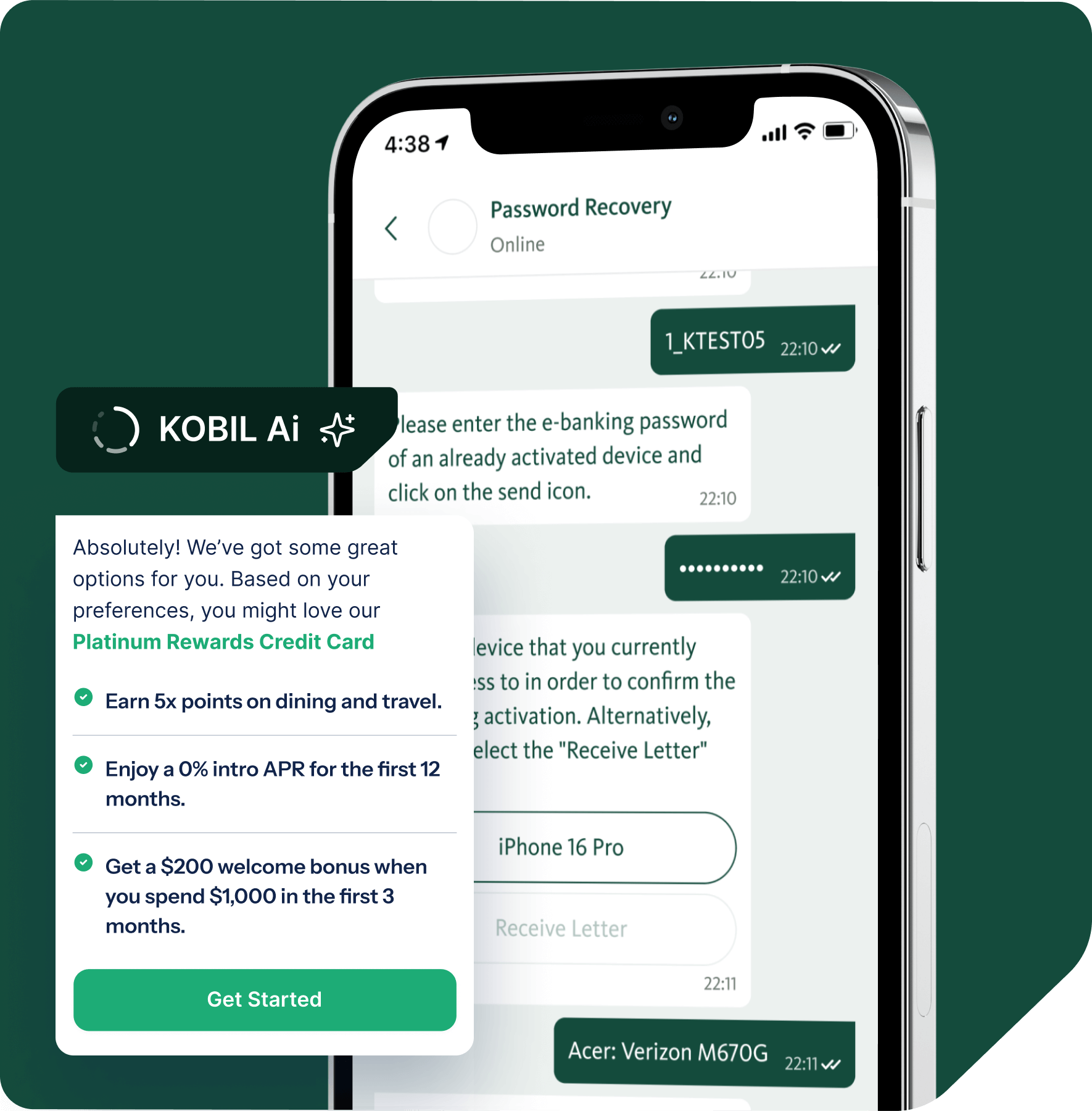

Secure Communication

Transform Customer Engagement.

With mChat, engage your customers in a secure, compliant way:

Send real-time transaction notifications or account updates.

Offer instant support via AI-enhanced chatbots or human agents.

Simplify complex processes like loan approvals or investment guidance through interactive, secure messaging.

Result: Improved customer satisfaction and reduced service costs.

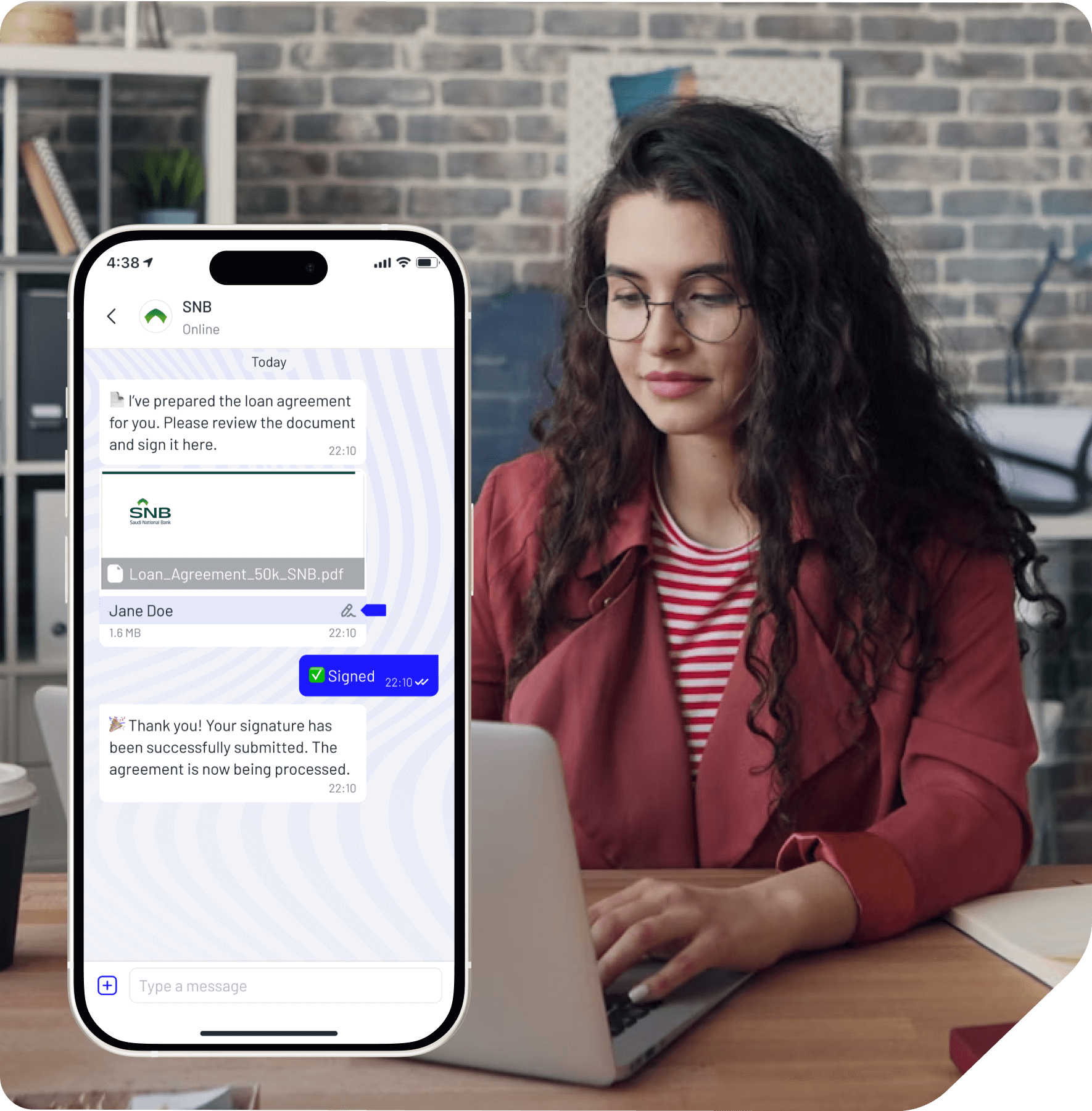

Digital Signatures

Modernizing Approvals and Agreements.

Replace slow, manual processes with mSign:

Enable legally binding signatures for contracts, agreements, and KYC processes.

Use AI to ensure compliance and verify authenticity.

Integrate signatures seamlessly into existing workflows for maximum efficiency.

Result: Save time, reduce costs, and deliver a modern customer experience.

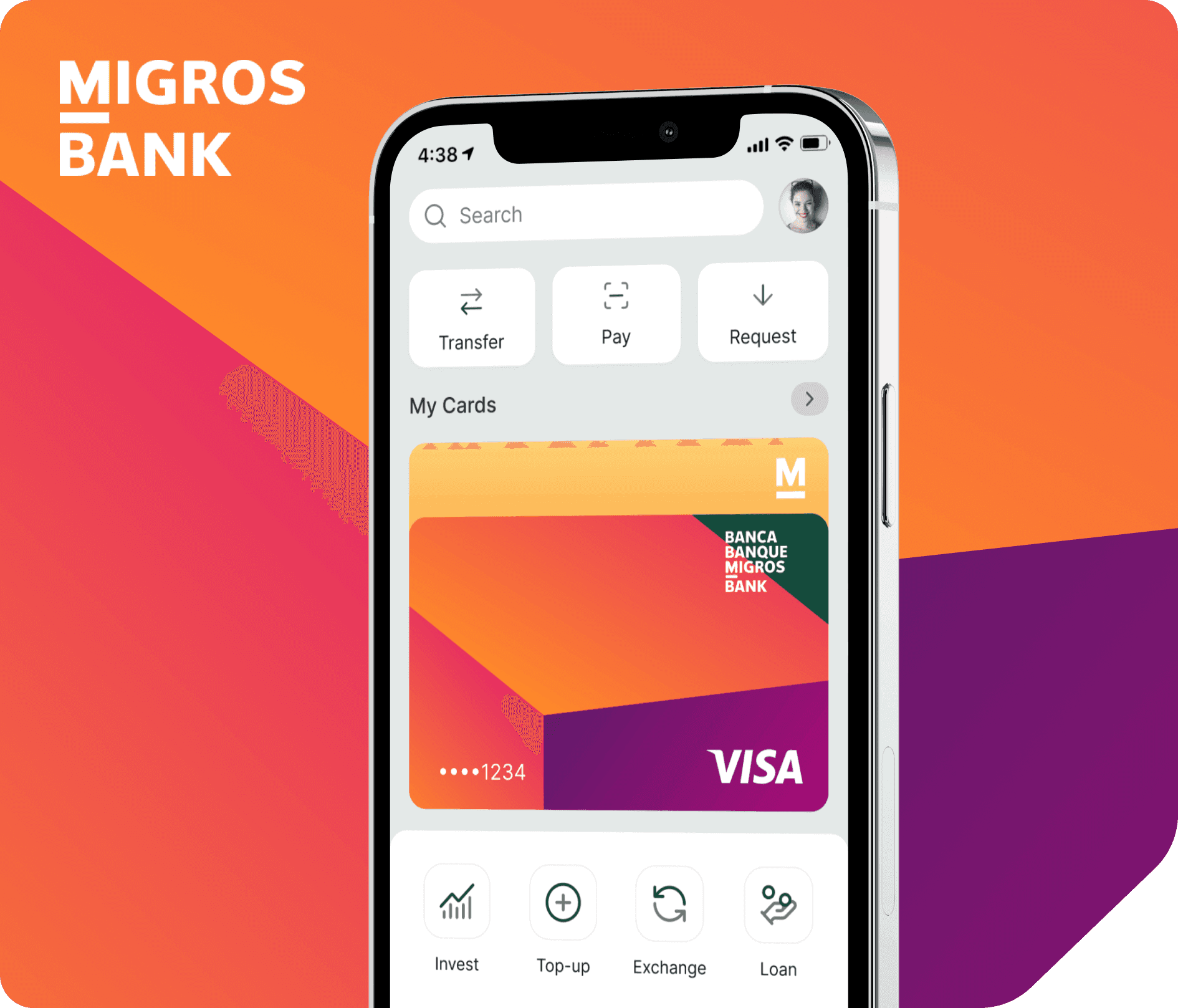

Case Study

Migros Bank, Secure Digital Banking

Challenge

As a leading financial institution, Migros Bank needed a solution to modernize their app while ensuring top-notch security and compliance.

Solution

With KOBIL’s platform, Migros Bank integrated:

Strong digital identity for seamless login and authentication.

Secure chat for real-time customer engagement.

Digital signatures for paperless agreements.

Results

Reduced customer onboarding time by 50%.

Enhanced customer satisfaction scores by 35%.

Achieved full compliance with PSD2 and GDPR regulations.

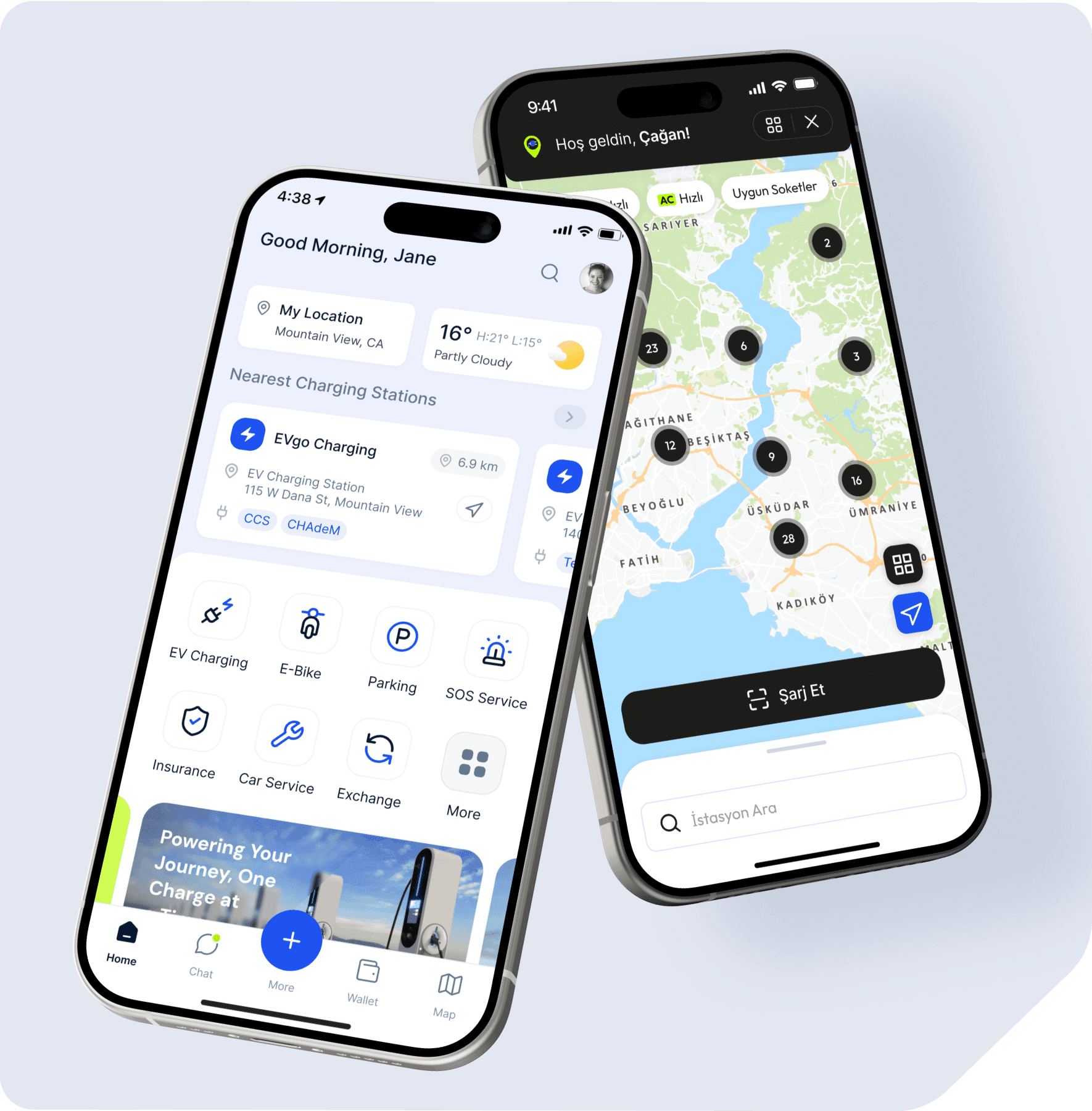

Tailored for Fintechs

Accelerate Your Growth.

For Fintechs, speed and scalability are everything. KOBIL’s solutions help you:

Launch faster with modular solutions like OneID4All™ and OneAPP4All™.

Focus on innovation while we handle identity, security, and compliance.

Scale effortlessly with cross-platform MiniApps powered by low-code development.

From challenger banks to payment providers and robo-advisors, KOBIL provides the building blocks for every Fintech business model.

Omni-Channel Ecosystem

Expand Without Limits.

With OneAPP4All™, you can:

Launch a branded SuperApp that integrates all customer-facing services.

Add MiniApps for new offerings like investment tools, credit calculators, or reward programs.

Scale your ecosystem with low-code development for fast deployment across platforms.

With OneID4All™, integrate the same powerful features directly into your app via SDK:

Start with strong digital identity, then add secure chat, digital signatures, and payments over time.

Build a customized solution that aligns perfectly with your business.

Result: Future-proof your business with scalable, modular solutions.

Built for Compliance. Ready for the Future.

Regulations are non-negotiable in the financial industry. With KOBIL, compliance isn’t a hurdle - it’s an enabler.

Trust KOBIL to deliver security, compliance, and innovation in one platform.

PSD2 (Payment Services Directive 2)

Full SCA compliance for secure payments.

GDPR

Protect customer data with end-to-end encryption.

eIDAS

Legally binding digital signatures for financial documents.

ISO 27001

Enterprise-grade information security management.

Why KOBIL? The Ultimate Partner for Financial Services.

Security Beyond Compare.

Device-Bound Identities

Trust rooted in hardware-level security.

AI-Driven Threat Detection

Stop fraud before it happens.

Continuous Monitoring

Real-time analysis to safeguard every transaction.

Cost Efficiency and Scalability.

Modular solutions that grow with your business.

Reduce operational costs with automated processes and secure communication.

Customer-Centric Innovation.

Frictionless experiences that build loyalty.

Future-ready technology to meet evolving customer expectations.

Compliance Without Compromise.

Globally recognized certifications and adherence to key regulations.

Build the Future of Finance Today.

KOBIL. Secure Innovation. Trusted by Banks and Fintechs. Loved by Customers.