KOBIL for Insurance

Revolutionizing Insurance with Secure Digital Transformation

In an industry where trust and reliability define success, insurers face the challenge of delivering seamless digital experiences while ensuring data security and regulatory compliance.

Trust and Security: The Pillars of Modern Insurance.

KOBIL enables insurance providers to build secure, efficient, and customer-centric digital solutions. From identity verification and secure communication to digital signatures and automated claims processes, we empower insurers to embrace the future with confidence.

Key Use Cases for the

Insurance Industry

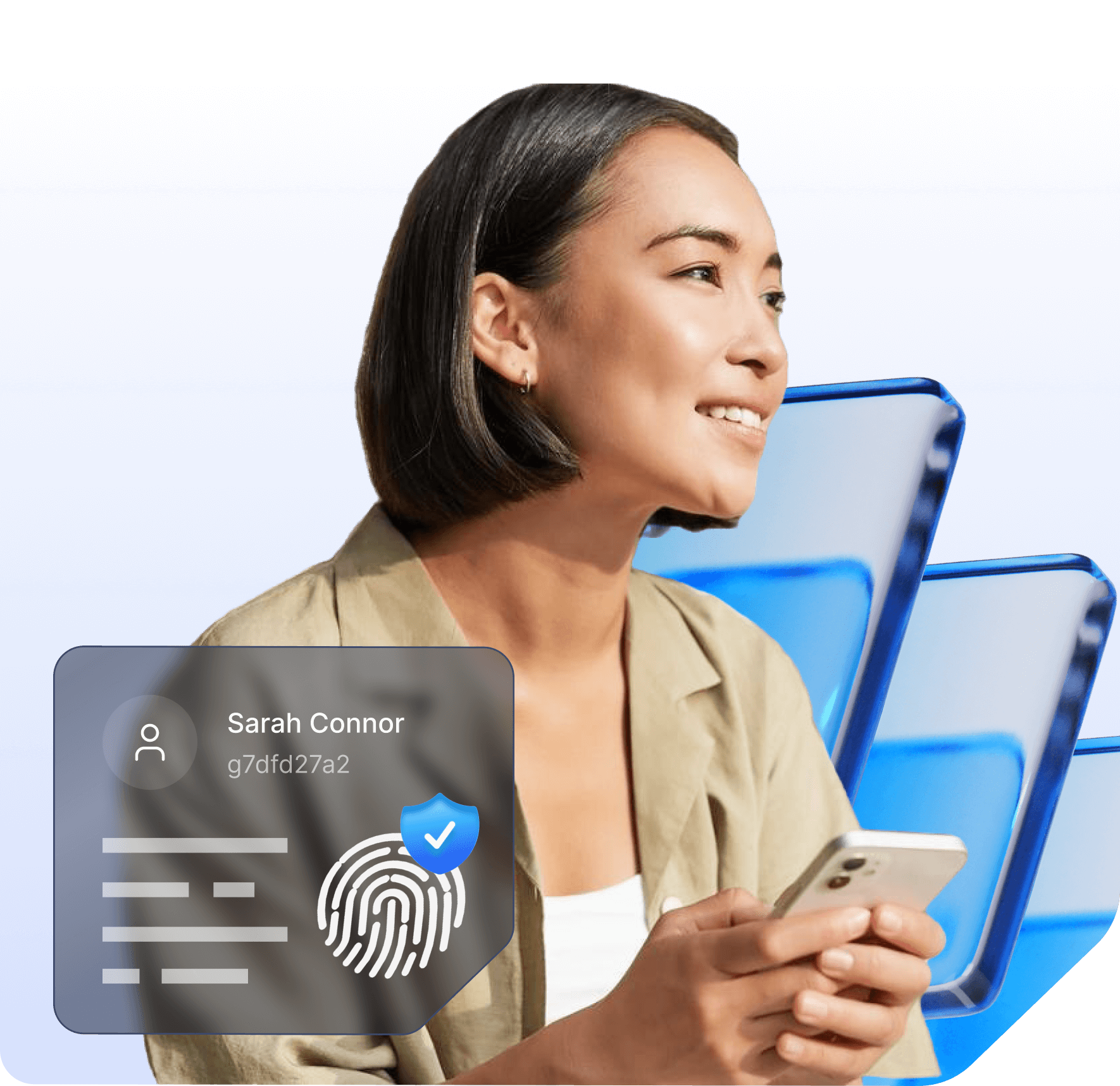

Seamless Policy Onboarding and

Identity Verification

Make the first interaction with your customers seamless and secure:

AI-Driven KYC

Authenticate policyholders quickly and accurately.

Frictionless Onboarding

Bind user identities securely to their devices.

Regulatory Confidence

Comply with GDPR, AML, and eIDAS standards effortlessly.

Result: Faster onboarding, reduced paperwork, and improved customer satisfaction.

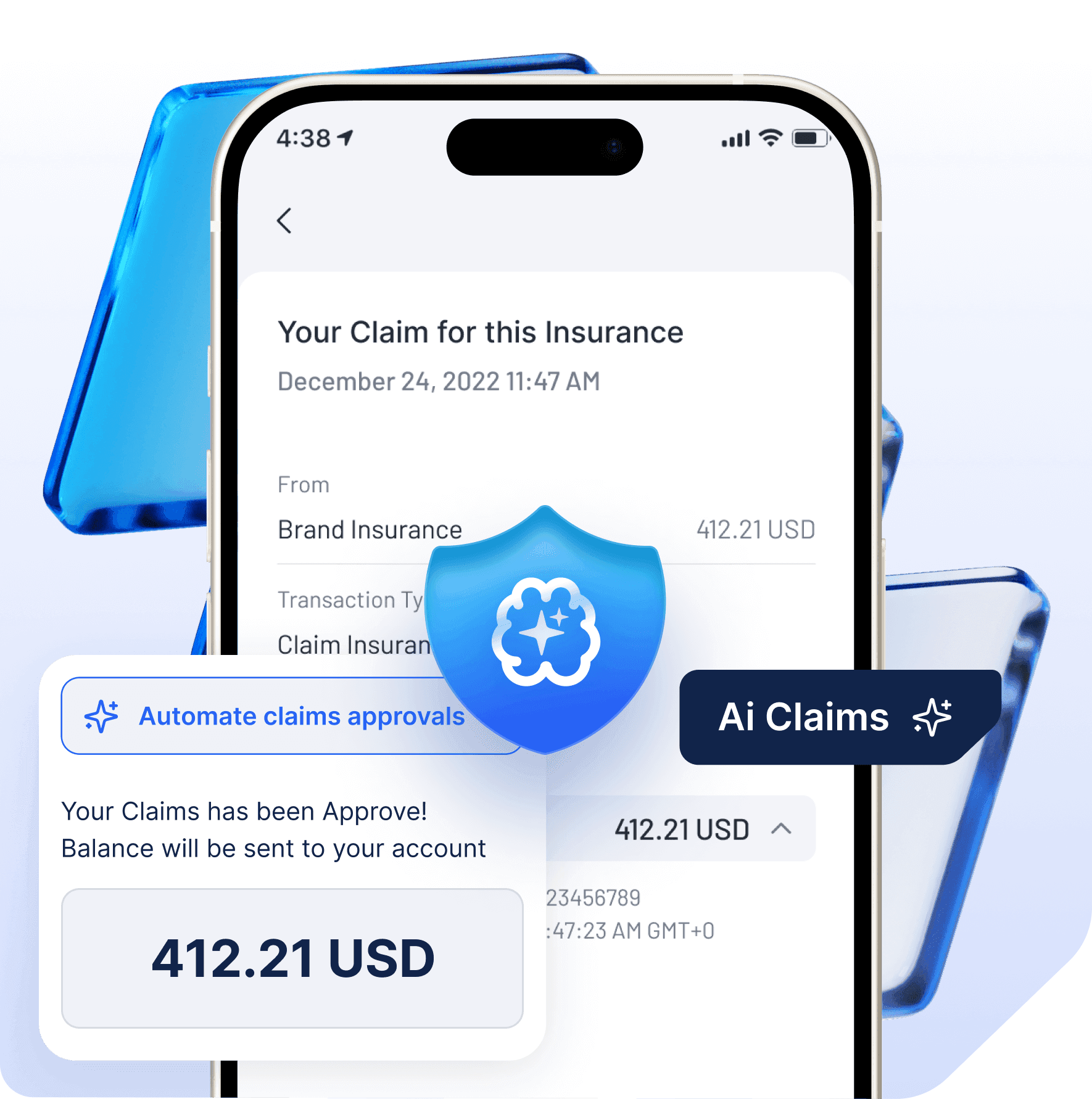

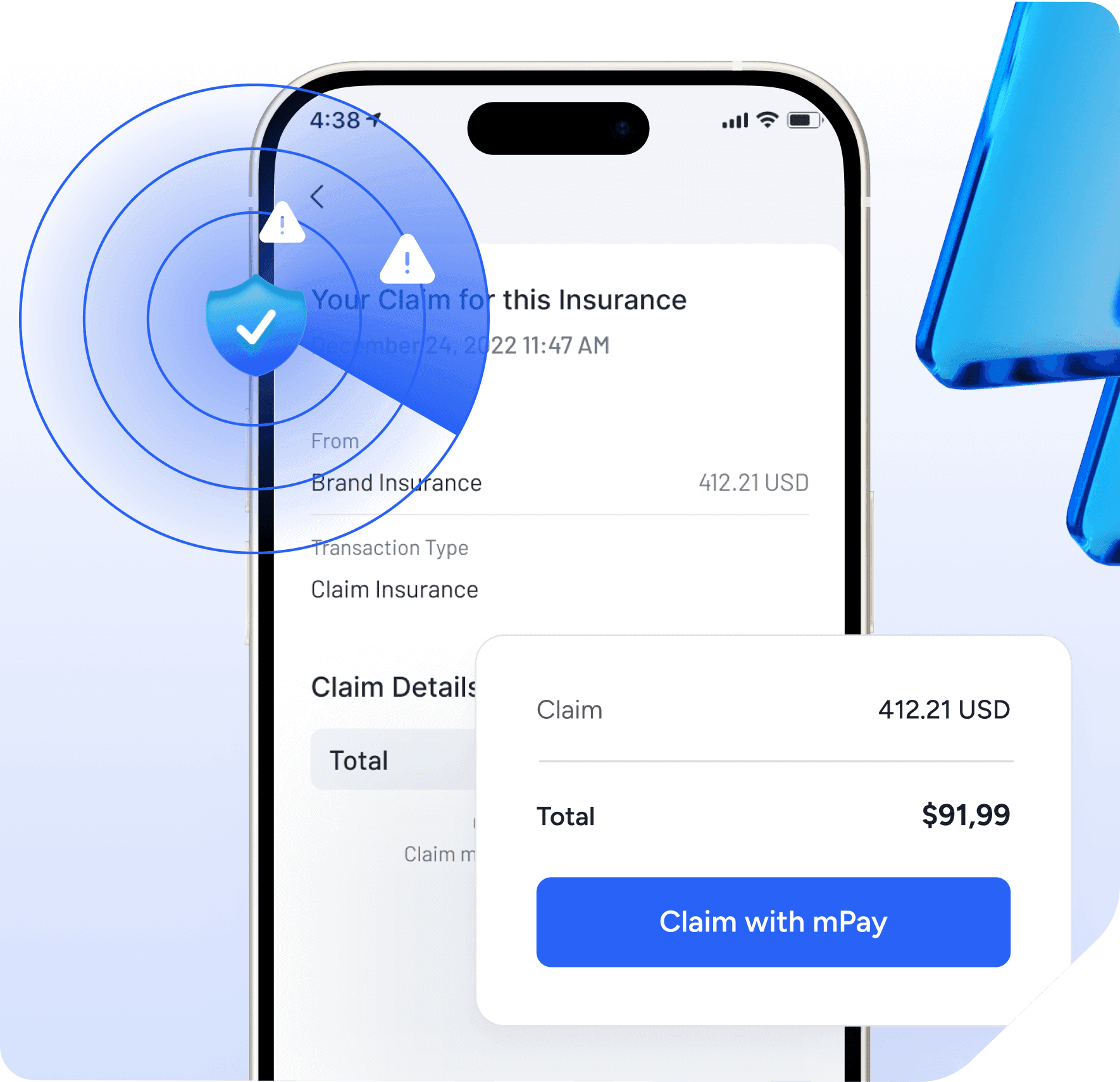

Automated Claims Processing

Faster Resolutions, Happier Customers.

Claims are the most critical touchpoint for insurers. With KOBIL, you can:

Automate claims approvals using AI-powered verification.

Enable policyholders to submit documents securely via their mobile devices.

Leverage digital signatures to finalize claims agreements instantly.

Result: Faster claim resolutions, lower operational costs, and enhanced customer trust.

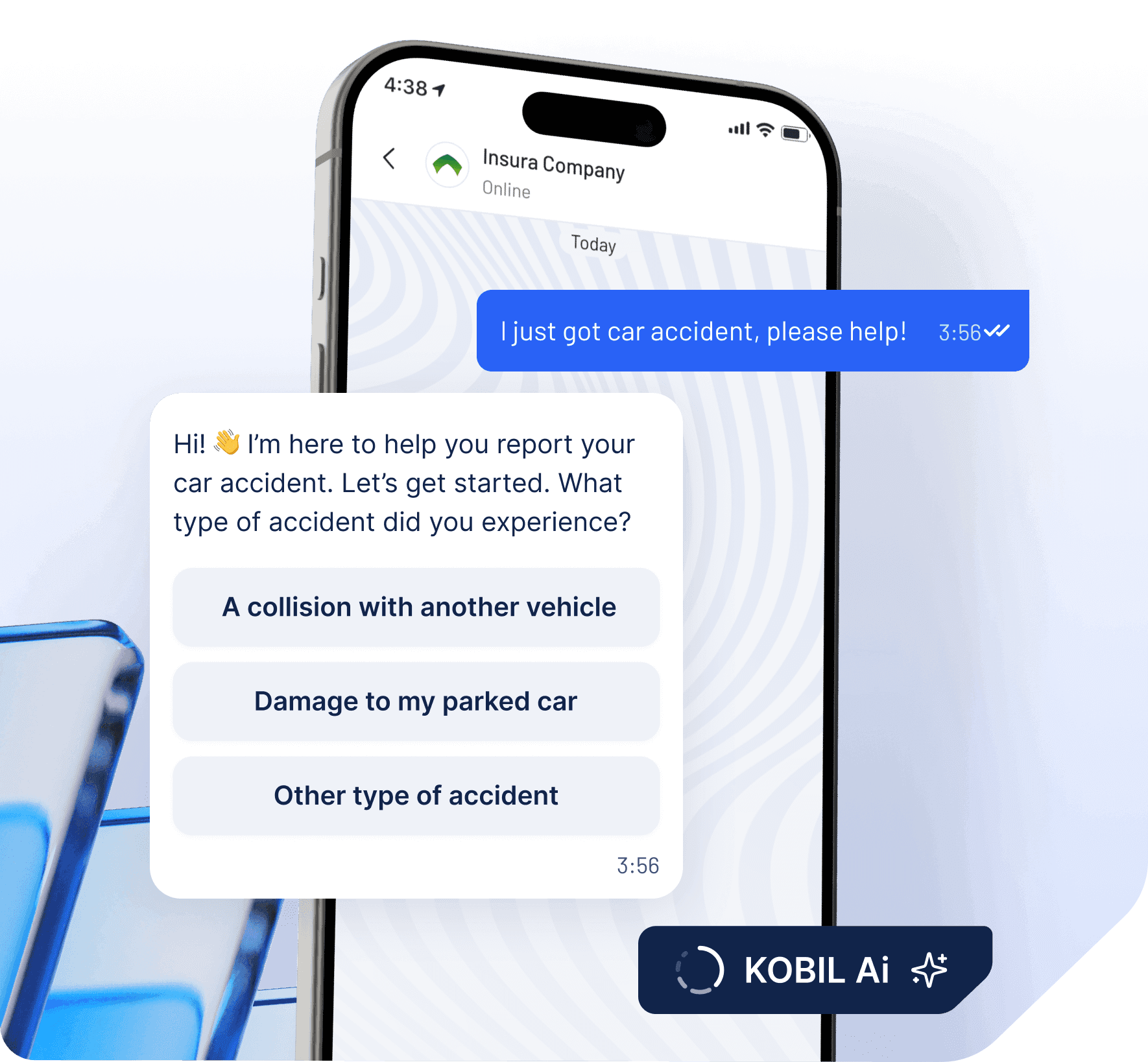

Secure Communication

Secure Communication with Policyholders.

Effective communication builds loyalty. With mChat, insurers can:

Send real-time policy updates or payment reminders.

Enable secure chat channels for claims or policy inquiries.

Use AI-driven chatbots to handle common customer queries instantly.

Result: Improved customer engagement and reduced support costs.

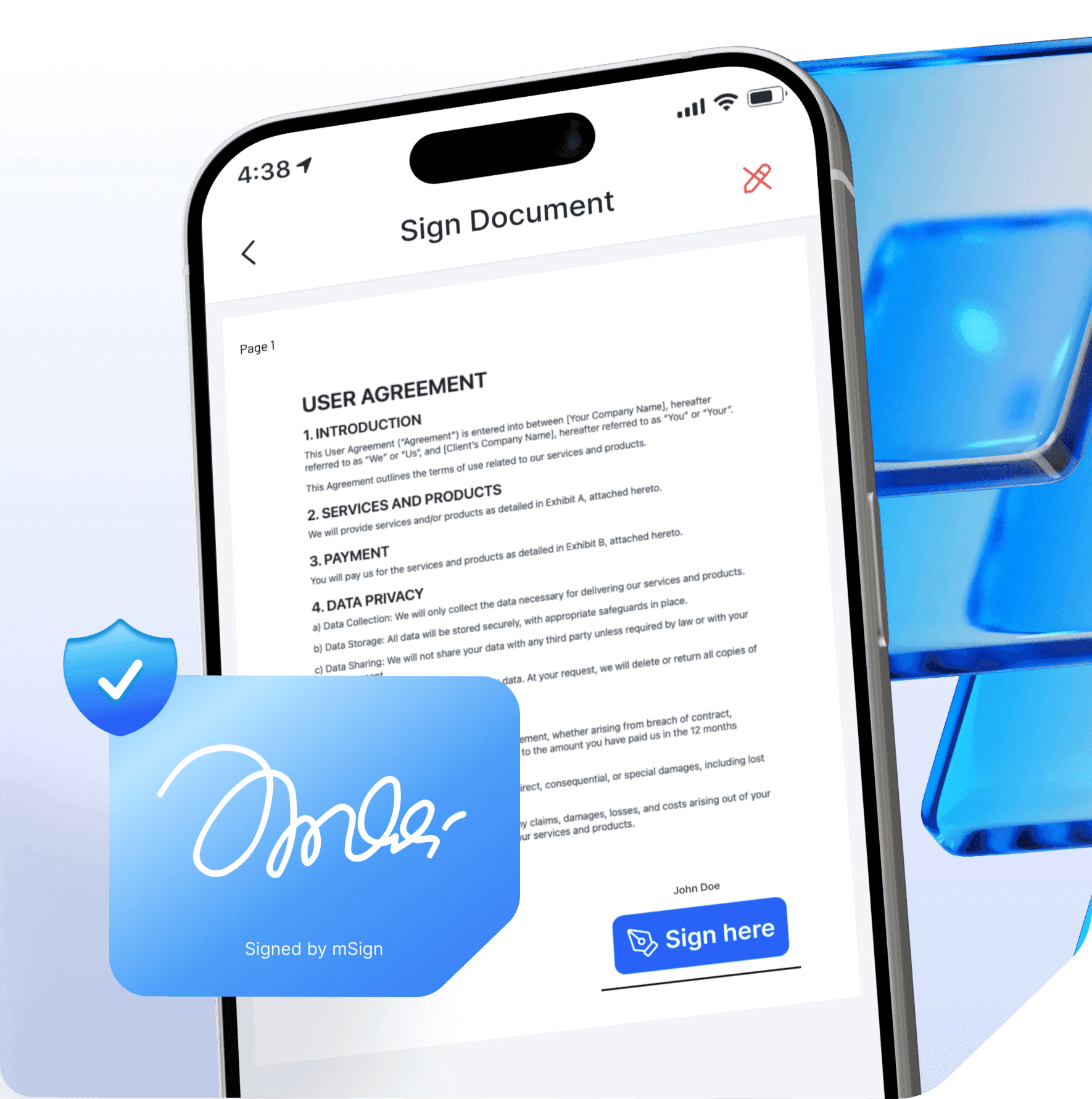

Digital Signatures

Digital Signatures for Agreements and Contracts.

Replace slow, manual signing processes with mSign:

Securely finalize insurance contracts, policy changes, and claims approvals.

Ensure legal compliance with eIDAS-certified digital signatures.

Simplify multi-party agreements with remote, real-time signing capabilities.

Result: Reduced processing times and an eco-friendly, paperless workflow.

Payment Solutions

Payment Solutions Tailored for Insurance.

Simplify premium collection and payouts with mPay:

Offer policyholders one-click payment options for premiums or claims disbursements.

Integrate secure payment flows directly into your app.

Use AI-driven fraud detection to safeguard transactions.

Result: Frictionless payment experiences and reduced risk of payment fraud.

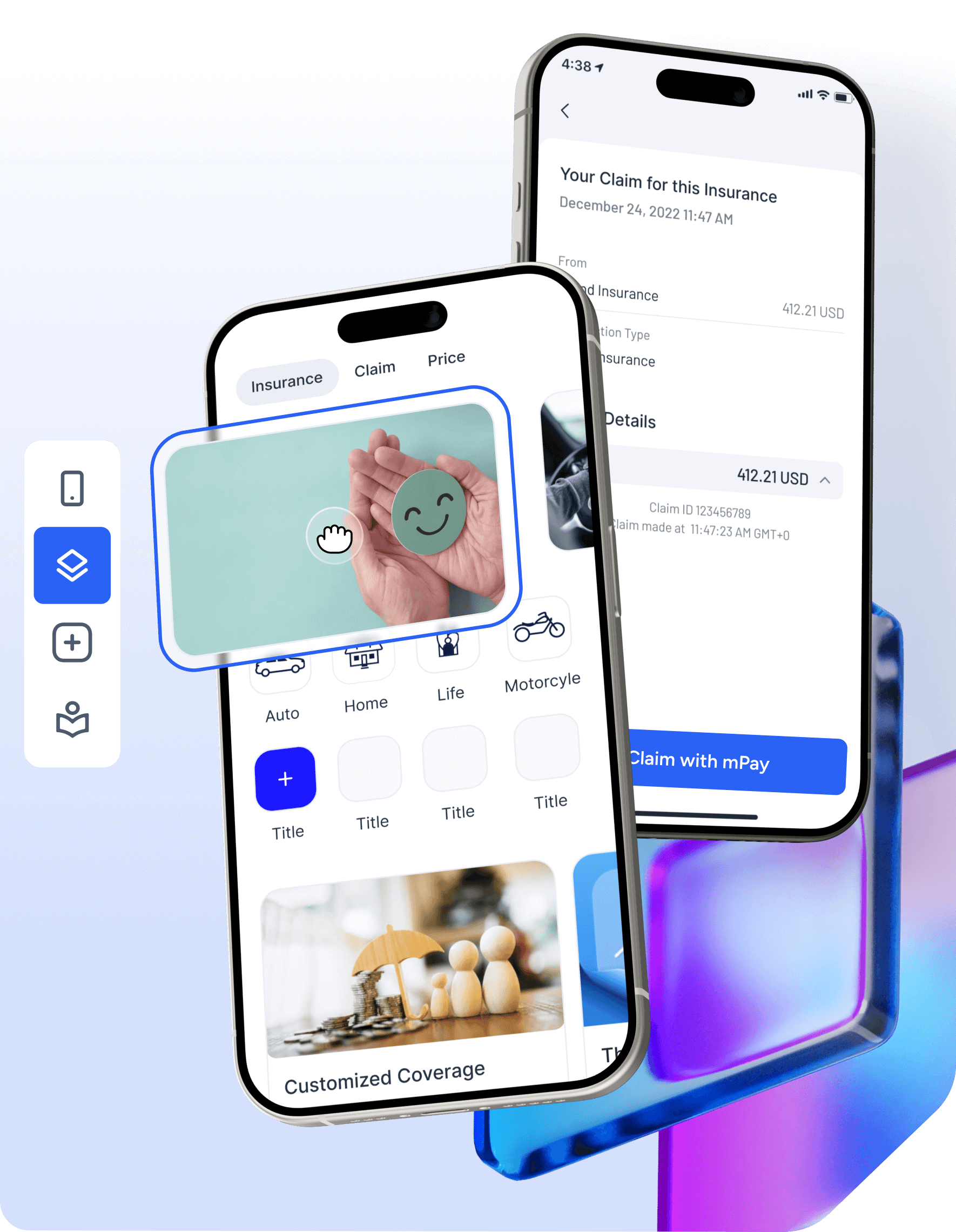

Building Digital

Building a Digital Insurance Ecosystem.

With OneAPP4All™, insurers can:

Launch a branded SuperApp that integrates policy management, claims tracking, and partner services.

Add MiniApps for value-added services like health programs, vehicle diagnostics, or retirement planning tools.

Scale offerings quickly with low-code development, reducing time-to-market.

For insurers preferring a tailored integration, OneID4All™ offers:

Seamless SDK Integration

Add identity verification, secure communication, and payments into existing platforms.

Step-by-Step Scalability

Start with digital onboarding and grow into a fully digital ecosystem.

Result: A scalable, future-proof digital insurance ecosystem.

Built for Compliance. Designed for Insurance.

Regulations are critical for insurers. KOBIL ensures compliance while delivering innovation:

GDPR

Protect customer data with end-to-end encryption.

eIDAS

Ensure legally binding digital signatures for all agreements.

ISO 27001

Adopt the highest global standards for information security.

AML (Anti-Money Laundering)

Simplify customer due diligence with AI-driven identity verification.

With KOBIL, compliance is effortless and built into every solution.

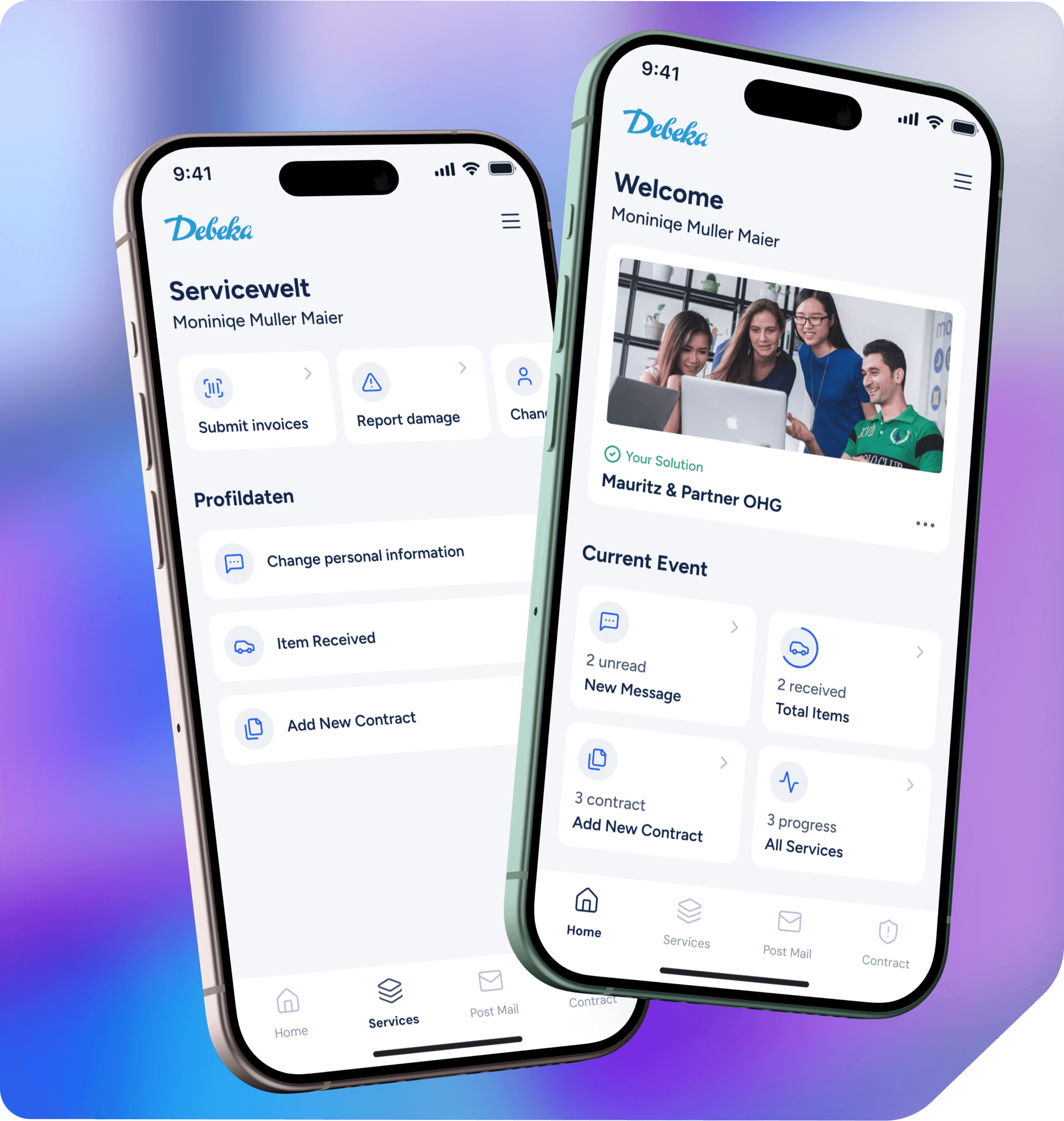

Case Study

Debeka - Transforming Insurance with KOBIL

Challenge

As one of Germany’s largest insurers, Debeka needed a solution to modernize its digital offerings, improve claims efficiency, and enhance customer engagement.

Solution

With KOBIL’s platform, Debeka implemented:

mIDentity for secure customer login and policyholder identity verification.

mChat for real-time communication and claims updates.

mSign for digital signatures, streamlining contracts and approvals.

Results

Reduced claims processing times by 40%.

Increased customer satisfaction scores by 30%.

Achieved full compliance with GDPR and eIDAS regulations.

Why KOBIL? The Ultimate Partner for Insurance.

Security That Builds Trust.

Device-Bound Identities

Ensure only authorized users access sensitive data.

AI-Powered Threat Detection

Prevent fraud and protect customer information.

End-to-End Encryption

Safeguard communications, payments, and contracts.

Compliance Without Compromise.

Adherence to GDPR, AML, eIDAS, and ISO 27001 standards.

Real-time monitoring for regulatory confidence.

Efficiency and Scalability.

Modular solutions that adapt to your business needs.

Automate manual processes, reducing costs and improving productivity.

Customer-Centric Innovation.

Deliver seamless digital experiences that drive loyalty.

Future-ready technology for evolving customer expectations.

Empower the Future of Insurance Today.

KOBIL. Trusted by Insurers. Loved by Customers. Compliant Everywhere.